Personal Finance

Crafting Your Wealth: Smart Dollar Wealth Building Strategies

Exploring the realm of smart dollar wealth building strategies unveils a path to financial success paved with strategic insights and practical tips. Delve into this guide to discover the key components that can lead you towards a prosperous future.

As we navigate through the intricacies of financial planning and wealth accumulation, it becomes evident that adopting smart dollar strategies can make a significant difference in securing your financial well-being.

Smart Dollar Wealth Building Strategies

Smart dollar wealth building strategies refer to a set of financial actions and decisions aimed at growing wealth efficiently and effectively over time. These strategies focus on maximizing the potential of every dollar earned or saved to achieve long-term financial success.

Key Components of a Successful Wealth Building Strategy

A successful wealth building strategy typically consists of the following key components:

- Setting Clear Financial Goals: Defining specific, measurable, achievable, relevant, and time-bound (SMART) financial objectives.

- Creating a Budget: Establishing a detailed budget to track income, expenses, and savings, ensuring financial discipline.

- Investing Wisely: Making informed investment decisions based on risk tolerance, time horizon, and financial goals.

- Managing Debt: Effectively managing and reducing debt to avoid financial strain and improve overall financial health.

- Building Emergency Savings: Establishing an emergency fund to cover unexpected expenses and financial setbacks without derailing long-term goals.

Differences between Smart Dollar Wealth Building Strategies and Traditional Approaches

Smart dollar wealth building strategies differ from traditional approaches in several ways:

- Focus on Efficiency: Smart strategies prioritize maximizing the impact of each dollar spent or saved, ensuring optimal use of financial resources.

- Long-Term Perspective: Smart strategies emphasize long-term financial planning and goal setting, rather than short-term gains or quick fixes.

- Personalization: Smart strategies are tailored to individual financial situations, goals, and risk tolerances, offering a customized approach to wealth building.

- Embrace Technology: Smart strategies leverage technology and digital tools to automate processes, track progress, and make informed financial decisions.

Setting Financial Goals

Setting clear financial goals is crucial when implementing wealth-building strategies. These goals provide a roadmap for your financial journey and help you stay focused and motivated along the way. Without specific targets in mind, it can be challenging to measure progress and make informed decisions to grow your wealth effectively.One approach to setting financial goals that align with smart dollar wealth building is to follow the SMART criteria.

This means goals should be Specific, Measurable, Achievable, Relevant, and Time-bound. By adhering to these principles, individuals can enhance their wealth-building progress and increase the likelihood of success.

Examples of Short-term and Long-term Financial Goals

- Short-term financial goal: Save $500 per month for an emergency fund within the next six months. This goal is specific (saving a set amount), measurable (trackable progress), achievable (within a reasonable timeframe), relevant (important for financial security), and time-bound (six months).

- Long-term financial goal: Purchase a home within five years by saving for a down payment and improving credit score. This goal is specific (buying a house), measurable (saving and credit score improvement), achievable (with a solid plan), relevant (long-term financial stability), and time-bound (five years).

Budgeting and Saving

Budgeting plays a crucial role in smart dollar wealth building strategies by helping individuals track their expenses, identify areas for saving, and allocate funds towards financial goals. By creating and sticking to a budget, individuals can effectively manage their income and expenses, ultimately maximizing their savings potential.

Different Budgeting Techniques

- The 50/30/20 rule: This technique involves allocating 50% of income towards needs, 30% towards wants, and 20% towards savings and debt repayment.

- Zero-based budgeting: With this approach, every dollar earned is assigned a specific purpose, ensuring that all income is allocated towards expenses, savings, or debt payment.

- Envelope system: By dividing cash into different envelopes for various expense categories, individuals can limit their spending to the amount available in each envelope, promoting better budget adherence.

Consistent budgeting helps individuals stay on track with their financial goals and ensures that they are not overspending, thus increasing their savings over time.

Significance of Emergency Funds

Emergency funds are essential for long-term wealth building as they provide a financial safety net in case of unexpected expenses or income disruptions. By setting aside a portion of their income into an emergency fund, individuals can avoid dipping into their savings or going into debt during emergencies, ultimately safeguarding their financial stability.

Investing Wisely

Investing wisely is a crucial component of building wealth over time. By strategically allocating your funds into different investment vehicles, you can potentially grow your wealth and secure your financial future.

Different Investment Vehicles

When it comes to investing, there are various options available such as stocks, bonds, real estate, and mutual funds. Each of these investment vehicles comes with its own set of risks and potential returns. Stocks offer the potential for high returns but also come with higher volatility.

Bonds, on the other hand, provide a more stable but lower return compared to stocks. Real estate can be a great way to build wealth through property appreciation and rental income. Mutual funds offer diversification by pooling funds from multiple investors to invest in a portfolio of securities.

Tips for Mitigating Risks and Maximizing Returns

- Do thorough research before investing in any asset class. Understand the market trends, historical performance, and potential risks involved.

- Diversify your investment portfolio to spread out risks. By investing in different asset classes, you can reduce the impact of a single investment underperforming.

- Regularly review and rebalance your investment portfolio to align with your financial goals and risk tolerance. Rebalancing ensures that your portfolio stays diversified and in line with your objectives.

- Consider seeking advice from a financial advisor to help you make informed investment decisions and create a personalized investment strategy based on your financial situation.

- Stay updated on market news and economic developments that could impact your investments. Being informed allows you to make timely adjustments to your portfolio when necessary.

Debt Management

Debt can have a significant impact on wealth building efforts, as it can drain financial resources through interest payments and limit the ability to invest in assets that generate income. Effective debt management is crucial for accelerating wealth accumulation by reducing financial burdens and freeing up funds for wealth-building opportunities.

Good Debt vs. Bad Debt

Understanding the difference between good debt and bad debt is essential for financial health. Good debt is typically used to finance assets that appreciate over time or generate income, such as a mortgage for a home or a loan for a business.

On the other hand, bad debt is incurred for non-essential items that decrease in value or do not generate income, like credit card debt for luxury purchases.

Strategies for Debt Management

- Develop a repayment plan: Prioritize high-interest debt and pay more than the minimum amount to reduce overall interest costs.

- Consolidate debt: Consider consolidating high-interest debt into a lower-interest loan to streamline payments and save on interest.

- Live below your means: Cut unnecessary expenses to free up more funds for debt repayment and wealth-building activities.

- Negotiate with creditors: Reach out to creditors to explore options for lowering interest rates or negotiating payment plans.

- Build an emergency fund: Having savings set aside for unexpected expenses can prevent the need to take on additional debt in times of financial strain.

Summary

In conclusion, smart dollar wealth building strategies offer a roadmap to financial stability and growth. By incorporating these strategies into your financial planning, you pave the way for a secure and prosperous future. Take charge of your financial journey today and watch your wealth grow steadily over time.

FAQ Resource

How do smart dollar wealth building strategies differ from traditional approaches?

Smart dollar strategies focus on maximizing the efficiency of each dollar spent or invested, leading to faster wealth accumulation compared to traditional methods.

What are some examples of short-term financial goals aligned with smart dollar wealth building?

Short-term goals like building an emergency fund, paying off high-interest debt, or starting a side business can align with smart dollar strategies.

How can budgeting contribute to smart dollar wealth building strategies?

Effective budgeting ensures that your money is allocated wisely, maximizing savings and investments in alignment with your wealth building goals.

What is the significance of emergency funds in long-term wealth building?

Emergency funds act as a safety net, protecting your investments and assets during unforeseen circumstances, thus safeguarding your long-term wealth accumulation.

How can one effectively manage and reduce debt to accelerate wealth accumulation?

By prioritizing high-interest debt, creating a structured repayment plan, and avoiding accumulating new debt, individuals can effectively manage debt and accelerate wealth accumulation.

-

Trading6 months ago

Trading6 months agoSilver MCX Live Price Real Time Updates: Stay Ahead in the Trading Game

-

Investment6 months ago

Investment6 months agoExploring the Best Index Funds to Invest in 2025

-

Investing6 months ago

Investing6 months agoSilver MCX Live Price with Real Time Updates: A Comprehensive Guide

-

Business6 months ago

Business6 months agoExploring Digilifes Digital Transformation Case Studies

-

technology6 months ago

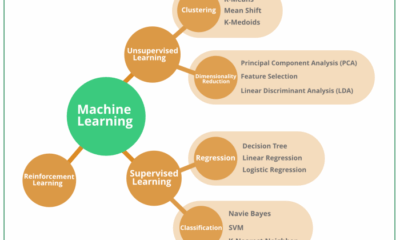

technology6 months agoExploring Machine Learning Algorithms: A Comprehensive Guide

-

Finance6 months ago

Finance6 months agoExploring BSE Midcap Index Today Market Insights

-

technology6 months ago

technology6 months agoUnveiling the Power of Digilife Business Intelligence Solutions

-

technology6 months ago

technology6 months agoUnveiling the Future: Digilife Global Technology Trends 2025