Investment

Exploring the Best Index Funds to Invest in 2025

Delve into the realm of investment with a focus on the best index funds to consider for 2025. This journey promises to uncover valuable insights and trends that can shape your investment decisions for the future.

As we navigate through the intricacies of index funds and their performance, you'll gain a deeper understanding of how to optimize your investment portfolio for the upcoming year.

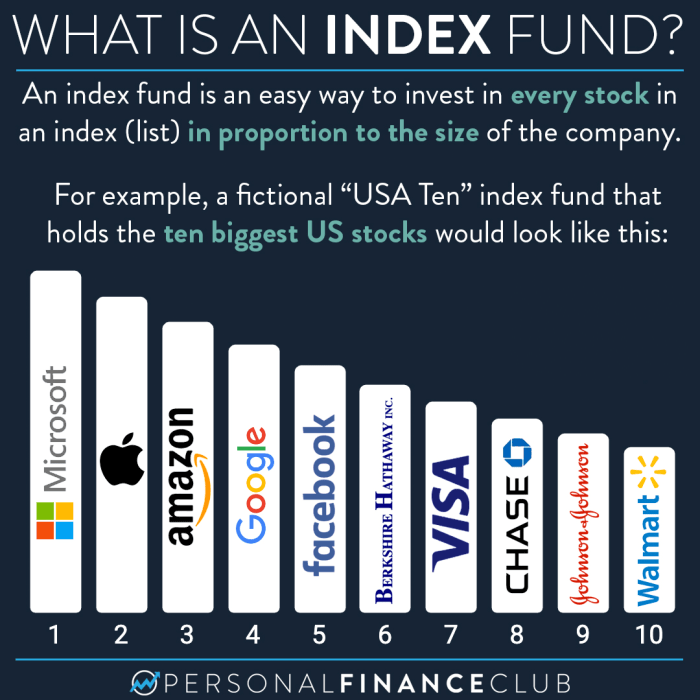

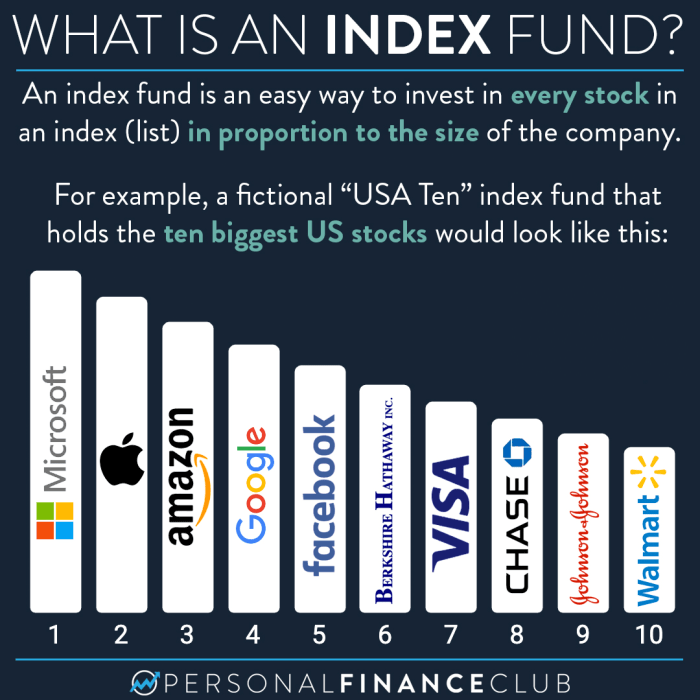

Overview of Index Funds

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks a specific market index, such as the S&P 500. The main purpose of index funds in investment portfolios is to provide investors with diversified exposure to a broad market or specific sector without the need for active management.

Investing in index funds offers several benefits, including lower management fees compared to actively managed funds, reduced risk through diversification, and the potential to match the returns of the underlying index over the long term. Additionally, index funds are known for their transparency, as they typically hold a basket of securities that mimic the composition of the target index.

How Index Funds Work

Index funds work by passively tracking the performance of a designated index by holding the same securities in the same proportions as the index itself. This passive management approach eliminates the need for continuous buying and selling of securities, reducing trading costs and tax implications.

- Index funds are structured to replicate the holdings of the target index, aiming to closely match its returns.

- Rebalancing of the fund's holdings is done periodically to ensure alignment with the index's composition.

- Investors can buy and sell shares of index funds on the open market, making them highly liquid investments.

Factors to Consider in Choosing Index Funds

When selecting index funds to invest in, there are several key factors that investors should consider to make informed decisions. These factors can significantly impact the overall performance of the investment portfolio and the returns generated over time.

Importance of Expense Ratios

Expense ratios play a crucial role in choosing index funds as they directly impact the overall returns that investors receive. These ratios represent the percentage of the fund's assets that are used to cover operating expenses. Lower expense ratios are generally preferred as they allow investors to keep more of their investment returns.

It is essential to compare expense ratios across different index funds to identify the most cost-effective options for long-term investment.

Impact of Diversification

Diversification is another critical factor to consider when selecting index funds. By investing in a diversified portfolio of assets, investors can reduce the risk associated with individual stocks or sectors. Index funds that offer broad market exposure across various industries and regions can help spread risk and enhance portfolio stability.

Diversification can also improve the overall performance of the investment by capturing returns from different market segments.

Top Performing Index Funds in 2025

Investing in index funds can be a great way to diversify your portfolio and potentially earn solid returns over time. Here, we will take a look at some of the top-performing index funds in 2025 based on historical performance.

Vanguard Total Stock Market Index Fund (VTSAX)

The Vanguard Total Stock Market Index Fund is known for its broad exposure to the U.S. stock market. It tracks the performance of the CRSP US Total Market Index and has shown consistent growth over the years. Investors looking for a low-cost way to invest in the entire U.S.

stock market may find VTSAX appealing.

iShares MSCI Emerging Markets ETF (EEM)

For investors looking to gain exposure to emerging markets, the iShares MSCI Emerging Markets ETF is a popular choice. This fund tracks the performance of the MSCI Emerging Markets Index and provides investors with access to stocks from developing economies

While investing in emerging markets can be riskier, it also offers the potential for higher returns.

Schwab U.S. Dividend Equity ETF (SCHD)

The Schwab U.S. Dividend Equity ETF focuses on high-quality U.S. companies that have a history of paying dividends. This fund tracks the Dow Jones U.S. Dividend 100 Index and provides investors with a way to invest in dividend-paying stocks.

SCHD may appeal to investors looking for a combination of growth and income in their portfolio.Investing in index funds, even top-performing ones, comes with risks. It's important for investors to consider factors such as market volatility, economic conditions, and fund expenses before making investment decisions.

While historical performance can provide insights, it's essential to conduct thorough research and consult with a financial advisor to make informed choices.

Emerging Trends in Index Fund Investment

As we look towards the future of index fund investment in 2025, it is essential to consider the emerging trends that are shaping the landscape of this market. These trends are influenced by technological advancements, global economic conditions, and changing investor preferences.

Impact of Technological Innovations

Technological innovations have significantly impacted index fund investing, making it more accessible and efficient for investors. Automation through robo-advisors and algorithmic trading has revolutionized the way index funds are managed, leading to lower fees and enhanced performance.

Global Economic Conditions

The global economic landscape plays a crucial role in determining the best index funds to invest in 2025. Factors such as interest rates, inflation, geopolitical events, and economic growth can influence the performance of different sectors and regions, impacting index fund returns.

Market Trends in Index Fund Investment

- Increasing focus on ESG (Environmental, Social, and Governance) criteria in index fund selection, reflecting a growing demand for socially responsible investing.

- Rise of thematic index funds targeting specific trends or industries, providing investors with opportunities to capitalize on emerging sectors such as clean energy, technology, and healthcare.

- Growth of passive investing strategies over active management, driven by the proven long-term benefits of low-cost index funds in outperforming actively managed funds.

Summary

In conclusion, the landscape of index fund investments for 2025 offers a myriad of opportunities and risks. By staying informed and making strategic choices, you can position yourself for financial success in the ever-evolving market.

FAQ Summary

What factors should I consider when choosing index funds?

When selecting index funds, it's crucial to look at expense ratios, historical performance, and the fund's objectives to align with your investment goals.

Are there any risks associated with investing in top-performing index funds?

While top-performing index funds can offer significant returns, they also come with risks such as market volatility and concentration in certain sectors.

How do global economic conditions influence the best index funds to invest in 2025?

Global economic conditions, such as interest rates and geopolitical events, can impact index fund performance by affecting individual sectors and overall market stability.

-

Trading6 months ago

Trading6 months agoSilver MCX Live Price Real Time Updates: Stay Ahead in the Trading Game

-

Investing6 months ago

Investing6 months agoSilver MCX Live Price with Real Time Updates: A Comprehensive Guide

-

Business6 months ago

Business6 months agoExploring Digilifes Digital Transformation Case Studies

-

technology6 months ago

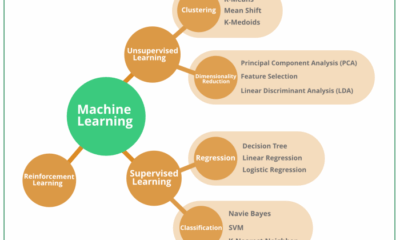

technology6 months agoExploring Machine Learning Algorithms: A Comprehensive Guide

-

Finance6 months ago

Finance6 months agoExploring BSE Midcap Index Today Market Insights

-

technology6 months ago

technology6 months agoUnveiling the Power of Digilife Business Intelligence Solutions

-

Personal Finance6 months ago

Personal Finance6 months agoCrafting Your Wealth: Smart Dollar Wealth Building Strategies

-

technology6 months ago

technology6 months agoUnveiling the Future: Digilife Global Technology Trends 2025