Finance

Exploring BSE Midcap Index Today Market Insights

Delving into BSE Midcap Index today market insights, this introduction immerses readers in a unique and compelling narrative. It provides an overview of the BSE Midcap Index, its significance, performance trends, sectoral analysis, and market insights in a concise yet engaging manner.

Overview of BSE Midcap Index

The BSE Midcap Index is a stock market index that represents the performance of the mid-sized companies listed on the Bombay Stock Exchange (BSE). These companies fall between the large-cap and small-cap categories, making the index a good indicator of the overall health of the mid-sized segment of the market.

Current Market Capitalization and Composition

The current market capitalization of the BSE Midcap Index stands at [insert current market capitalization data]. This index comprises a diverse range of mid-sized companies from various sectors such as finance, technology, healthcare, and consumer goods. Some well-known companies included in the index are [list a few examples].

Significance in the Broader Market

The BSE Midcap Index plays a crucial role in providing investors with insight into the performance of mid-sized companies, which are often considered to have growth potential. As these companies are not as established as large-cap firms, their performance can be more volatile, making the index a key benchmark for tracking market trends and assessing risk.

Additionally, the BSE Midcap Index can serve as a barometer for the overall economic climate, reflecting shifts in investor sentiment and market dynamics.

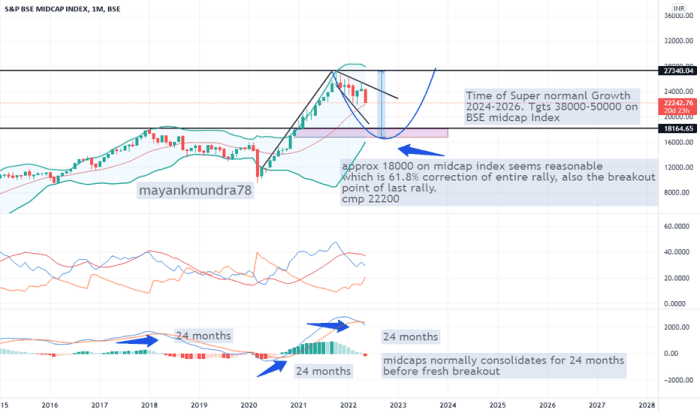

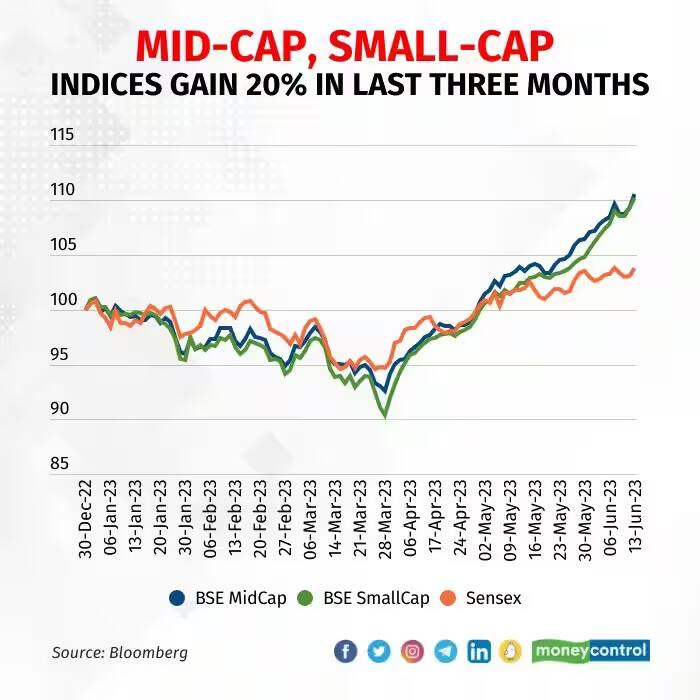

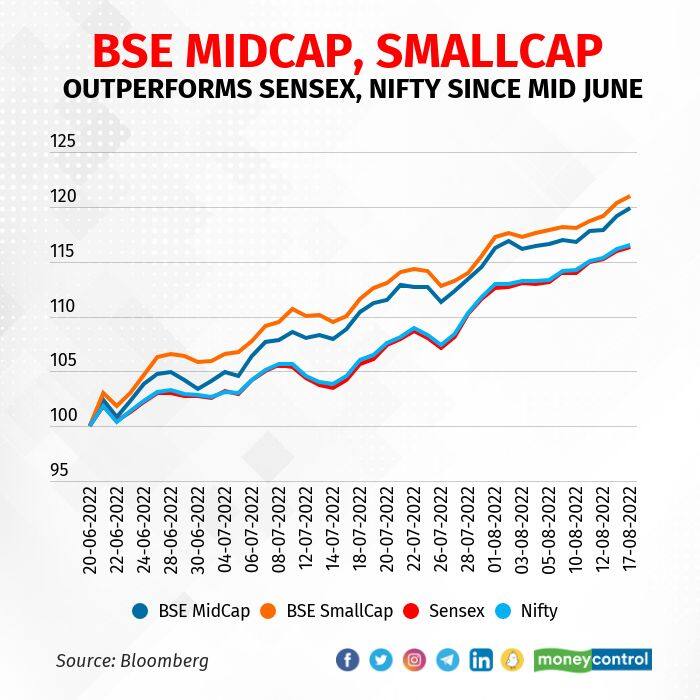

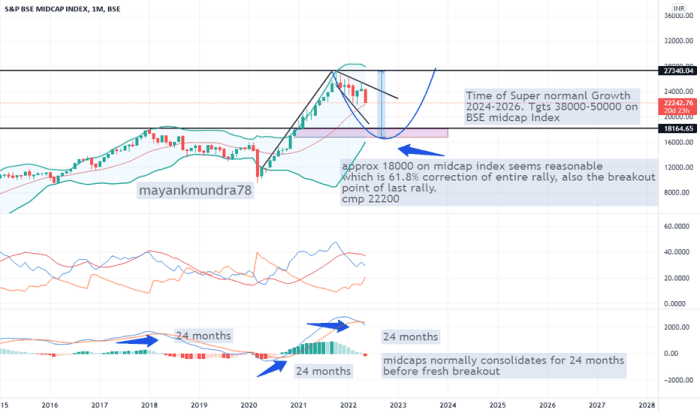

Performance Trends

Today, the BSE Midcap Index showed a noticeable increase in performance compared to historical data. This upward trend reflects the current market conditions and investor sentiment.

Comparison with Historical Data

- The BSE Midcap Index surged by X% today, marking a significant improvement over the past few trading sessions.

- This increase is a positive deviation from the average performance of the index over the last month.

- Comparing today's closing value to the index's performance a year ago, we can see a steady growth trajectory.

Recent Trends and Patterns

- Over the past week, the BSE Midcap Index has shown a consistent upward movement, indicating a bullish trend in the midcap segment.

- Investor interest in midcap stocks has been on the rise, contributing to the overall positive trend in the index.

- Technical indicators also suggest a strong buying momentum in midcap stocks, driving the index higher.

Factors Influencing Performance

- The current performance of the BSE Midcap Index can be attributed to positive market sentiments fueled by strong quarterly earnings reports from midcap companies.

- Government policies and economic indicators may also be playing a role in boosting investor confidence in midcap stocks.

- Institutional buying and sector-specific developments are further supporting the upward movement of the BSE Midcap Index.

Sectoral Analysis

In today's market insights on the BSE Midcap Index, it is crucial to delve into the sectoral analysis to understand the driving forces behind the index's performance. By comparing the performance of different sectors within the index, we can gain valuable insights into how sectoral movements impact the overall trajectory of the index.

Information Technology Sector

The Information Technology sector has been a major contributor to the positive performance of the BSE Midcap Index today

This has translated into strong financial performance and stock price appreciation for IT companies within the midcap segment.

Financial Services Sector

The Financial Services sector has also played a significant role in driving the performance of the BSE Midcap Index. With improving economic conditions and growing investor confidence, financial services companies have witnessed a boost in business activity. This has led to a positive impact on the overall sectoral performance and, consequently, the index as a whole.

Healthcare Sector

The Healthcare sector, with its defensive characteristics and resilient nature, has provided stability to the BSE Midcap Index during market fluctuations. As the demand for healthcare services and products remains steady, companies within this sector have demonstrated consistency in their performance.

This has helped cushion the index against volatility and contributed to its overall positive movement.

Market Insights

In today's market, the BSE Midcap Index is experiencing fluctuations due to recent news and economic indicators impacting investor behavior and sentiment towards midcap stocks.

Impact of Recent News and Events

The BSE Midcap Index has been influenced by the announcement of a new government policy aimed at boosting the economy. This has led to increased interest in midcap stocks as investors anticipate growth opportunities in sectors supported by the policy changes.

Market Sentiment and Investor Behavior

Investors are cautiously optimistic about the midcap segment, with a focus on sectors expected to benefit from the current economic climate. There is a sense of resilience among investors, who are closely monitoring market trends and company performance to make informed decisions.

Potential Opportunities and Risks

Investing in the BSE Midcap Index presents both opportunities and risks. While there is potential for high returns in a growing economy, the midcap segment can be volatile and susceptible to market fluctuations. It is essential for investors to conduct thorough research and diversify their portfolios to mitigate risks and capitalize on opportunities in the midcap space.

Final Summary

In conclusion, the discussion on BSE Midcap Index today market insights sheds light on the current scenario, trends, and factors influencing the market. It offers valuable insights for investors and enthusiasts alike, making it a must-read for those keen on understanding the dynamics of the midcap segment.

Answers to Common Questions

What does the BSE Midcap Index represent?

The BSE Midcap Index represents the performance of mid-sized companies listed on the Bombay Stock Exchange.

How is the performance of the BSE Midcap Index today compared to historical data?

The performance of the BSE Midcap Index today can be analyzed by comparing it to historical data to identify trends and patterns.

What sectors are currently driving the performance of the BSE Midcap Index?

Insights into the sectors driving the performance of the BSE Midcap Index today can provide valuable information for investors.

What recent news or events are affecting the BSE Midcap Index today?

Recent news, events, and economic indicators can impact the market sentiment and investor behavior towards midcap stocks.

Finance

Unlocking AI Investment Opportunities: A Comprehensive Guide

Delving into the world of AI investment opportunities, this guide aims to provide a detailed look at the potential benefits, risks, and emerging trends in this rapidly evolving sector.

As we navigate through the various facets of AI investments, we will explore key sectors, successful examples, advantages, challenges, and what the future holds for those looking to capitalize on this innovative field.

Overview of AI Investment Opportunities

Investing in artificial intelligence (AI) has become increasingly popular due to its potential to revolutionize various industries and drive significant returns on investment. AI investment opportunities involve allocating funds towards companies that develop or utilize AI technologies to enhance processes, improve efficiency, and drive innovation.Key sectors where AI investment opportunities are prevalent include healthcare, finance, e-commerce, autonomous vehicles, cybersecurity, and manufacturing.

In these sectors, AI technologies are being leveraged to streamline operations, personalize customer experiences, optimize decision-making processes, and enhance overall performance.Examples of successful AI investments in recent years include companies like NVIDIA, a leading provider of graphics processing units (GPUs) used in AI applications, which has seen significant growth in its stock value due to the increasing demand for AI hardware.

Additionally, companies like Alphabet (Google), Amazon, and Microsoft have made successful AI investments through acquisitions of AI startups and development of AI-powered products and services that have driven revenue growth and market expansion.

Benefits of Investing in AI

Investing in AI technologies offers numerous advantages that can lead to significant returns and opportunities for innovation in the business world. AI has the potential to revolutionize industries and drive growth in ways that traditional investments cannot match.

Potential Returns of AI Investments

Investing in AI can provide higher potential returns compared to traditional investments due to the ability of AI technologies to optimize processes, enhance decision-making, and improve overall efficiency. AI can analyze vast amounts of data at speeds unmatched by humans, leading to more informed and strategic investment decisions.

Driving Innovation and Creating Business Opportunities

AI has the power to drive innovation by enabling businesses to automate tasks, personalize customer experiences, and develop cutting-edge products and services. By leveraging AI technologies, companies can unlock new opportunities for growth and competitive advantage in the market. Additionally, AI can help businesses stay ahead of the curve by adapting to changing market trends and consumer preferences more effectively.

Risks and Challenges in AI Investments

Investing in AI comes with its own set of risks and challenges that investors need to be aware of. These risks can range from technical limitations to ethical dilemmas that can impact the success of AI investments.

Technical Limitations

AI technologies are still evolving, and there are inherent risks associated with investing in cutting-edge technologies. Issues such as data quality, algorithm bias, and model interpretability can lead to unexpected outcomes and poor investment performance.

Regulatory Hurdles

The regulatory landscape surrounding AI is complex and constantly changing

Ethical Considerations

Ethical concerns around AI, such as bias in algorithms, misuse of personal data, and job displacement, pose significant challenges for investors. Failing to address these ethical considerations can lead to reputational damage and legal repercussions for investment firms.

Examples of Failed AI Investments

One notable example of a failed AI investment is the case of Enron using AI algorithms to manipulate energy prices, leading to one of the biggest corporate scandals in history. Another example is the failure of Microsoft's chatbot, Tay, which was shut down within hours of its launch due to offensive and inappropriate behavior.Investors can learn valuable lessons from these examples by emphasizing transparency, accountability, and responsible AI deployment in their investment strategies.

Emerging Trends in AI Investment

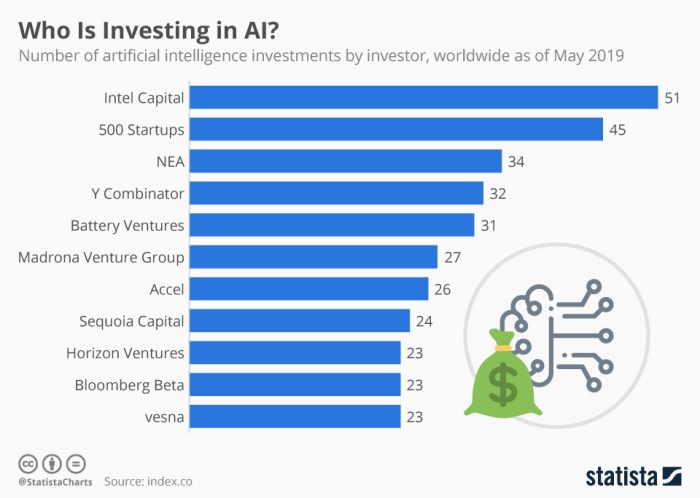

As the field of artificial intelligence continues to evolve rapidly, new trends are shaping the landscape of AI investments. These trends are influencing how AI startups attract funding and the role of venture capital firms in supporting these ventures.

AI Startups Attracting Investment in Different Markets

AI startups are attracting investment across various markets due to the increasing demand for AI technologies. In sectors such as healthcare, finance, and e-commerce, startups are leveraging AI to drive innovation and efficiency, making them attractive investment opportunities for venture capitalists.

Role of Venture Capital Firms in Funding AI Ventures

Venture capital firms play a crucial role in funding AI ventures by providing the necessary capital for startups to scale their operations and bring their AI solutions to market. These firms not only invest in AI startups but also provide strategic guidance and resources to help them succeed in a competitive market.

Conclusion

In conclusion, AI investment opportunities present a promising landscape for investors seeking to ride the wave of technological advancements. By understanding the risks, benefits, and trends in this space, individuals can make informed decisions to harness the potential growth and innovation AI has to offer.

Essential Questionnaire

What are some key sectors where AI investment opportunities are prevalent?

Key sectors include healthcare, finance, retail, and cybersecurity.

How do potential returns of AI investments compare to traditional investments?

AI investments have the potential for higher returns due to rapid technological advancements and innovation.

What are some examples of failed AI investments and the lessons learned?

One example is the failure of an AI-driven customer service chatbot due to lack of personalized responses, highlighting the importance of human oversight in AI applications.

Finance

Smart Ways to Grow Your Money: A Comprehensive Guide

Discovering smart ways to grow your money is essential for financial success. Whether you're a novice or an experienced investor, understanding key strategies can help you make the most of your money. From low-risk investments to passive income streams, this guide covers it all.

Ways to Invest Wisely

Investing wisely is crucial for growing your money effectively over time. By making informed decisions and following smart strategies, you can maximize your returns while minimizing risks. Here are some key factors to consider when investing:

Low-Risk Investment Options for Beginners

When starting out as an investor, it's important to focus on low-risk options that provide a steady return on investment. Some examples of low-risk investments suitable for beginners include:

- High-yield savings accounts

- Certificates of deposit (CDs)

- Treasury securities

- Index funds

These options offer relatively stable returns with minimal risk, making them ideal for those who are new to investing and want to build a foundation for their portfolio.

The Concept of Diversification in Investment Portfolios

Diversification is a key strategy in investing that involves spreading your investments across different asset classes and industries. By diversifying your portfolio, you can reduce the impact of market volatility on your overall returns. This means that if one investment performs poorly, others may help offset those losses.

Diversification is often referred to as "not putting all your eggs in one basket," as it helps protect your investments from significant downturns in any one sector.

The Importance of Setting Investment Goals and Timelines

Setting clear investment goals and timelines is essential for creating a structured investment plan. By defining your goals, whether it's saving for retirement, buying a house, or funding your children's education, you can tailor your investment strategy to meet those specific objectives.

Additionally, setting timelines helps you track your progress and make adjustments as needed to stay on target.Remember, investing wisely requires careful planning, research, and a long-term perspective. By incorporating these key principles into your investment strategy, you can work towards achieving your financial goals while managing risks effectively.

Saving Strategies for Growth

When it comes to growing your money, saving strategies play a crucial role in building a strong financial foundation. By implementing effective saving techniques, you can secure your future and work towards achieving your financial goals.

Creating a Budget for Effective Saving

Creating a budget is the first step towards saving money effectively. Start by tracking your expenses and identifying areas where you can cut back. Allocate a portion of your income towards savings every month and stick to your budget religiously.

By having a clear overview of your finances, you can make informed decisions and prioritize your saving goals.

Significance of Emergency Funds

Emergency funds are a vital component of financial planning as they provide a safety net during unexpected events such as medical emergencies, job loss, or car repairs. Aim to save at least three to six months' worth of expenses in your emergency fund to ensure you are prepared for any unforeseen circumstances.

Having this financial cushion can prevent you from dipping into your long-term savings or going into debt.

Advantages of Automating Savings

Automating your savings through apps or bank transfers can be a game-changer in your saving journey. Set up automatic transfers from your checking account to your savings account on a regular basis. This way, you can save money without even thinking about it.

Automating your savings ensures consistency and discipline in your saving habits, making it easier to reach your financial goals in the long run.

Exploring Passive Income Streams

Passive income streams are a great way to grow your wealth without having to actively work for every dollar earned. Let's explore some popular passive income ideas and how they can help accelerate your wealth accumulation.

Real Estate Investments

Real estate investments are a common passive income source where you purchase properties and earn rental income. While this can provide steady cash flow, it also involves risks such as market fluctuations and property maintenance costs.

Dividend Stocks

Investing in dividend stocks is another way to generate passive income. Companies pay out dividends to shareholders, providing a regular income stream. However, stock market volatility and company performance can affect dividend payouts.

Comparison of Passive Income Sources

- Real estate investments offer tangible assets but require hands-on management.

- Dividend stocks provide passive income with potential for capital appreciation.

- Both sources have risks, such as market volatility and economic downturns.

Accelerating Wealth Accumulation

By diversifying your passive income streams and reinvesting the earnings, you can accelerate wealth accumulation. For example, using rental income from real estate investments to purchase more properties or reinvesting dividends from stocks can compound your earnings over time.

Harnessing the Power of Compound Interest

Compound interest is the interest calculated on the initial principal, which also includes all of the accumulated interest from previous periods on a deposit or loan. It is a powerful concept that allows your money to grow exponentially over time, as the interest is earned on both the initial investment and the interest that has already been added to the balance.

Starting Early with Compound Interest

One of the key benefits of compound interest is the impact of starting to save and invest early. Let's consider an example to illustrate this point:

For instance, if you invest $1,000 at an annual interest rate of 5%, after one year, you would earn $50 in interest. In the second year, you would earn interest not only on the initial $1,000 but also on the $50 interest earned in the first year. This compounding effect continues to grow your investment over time.

Maximizing Compound Interest through Retirement Accounts

Retirement accounts, such as 401(k) or IRA, are excellent avenues to maximize the power of compound interest for long-term growth. These accounts offer tax advantages and often include employer matching contributions, further boosting your savings.

- Consider contributing the maximum amount allowed by the retirement account to take full advantage of the benefits.

- Choose investment options within the retirement account that align with your long-term financial goals and risk tolerance.

- Regularly review and adjust your contributions and investments to ensure they continue to work effectively towards building your retirement savings.

Final Wrap-Up

In conclusion, mastering the art of growing your money smartly is a journey worth embarking on. By implementing the tips and strategies discussed, you can pave the way towards a more secure financial future. Start today and watch your wealth grow exponentially.

FAQ

What are some low-risk investment options for beginners?

Beginners can consider options like index funds, bonds, or a high-yield savings account.

How can I automate my savings effectively?

You can set up automatic transfers from your checking account to your savings account or use budgeting apps that round up your purchases to save the spare change.

What is compound interest and why is it important?

Compound interest is the interest calculated on the initial principal, which also includes all the accumulated interest from previous periods. It's crucial because it helps your money grow faster over time.

Finance

Unlocking the Power of AI for Financial Services

As AI for financial services becomes increasingly prevalent, this introduction invites readers into a realm where technology reshapes the landscape of banking, investment management, and insurance. Get ready to explore the innovative applications and transformative impact of AI in the financial sector.

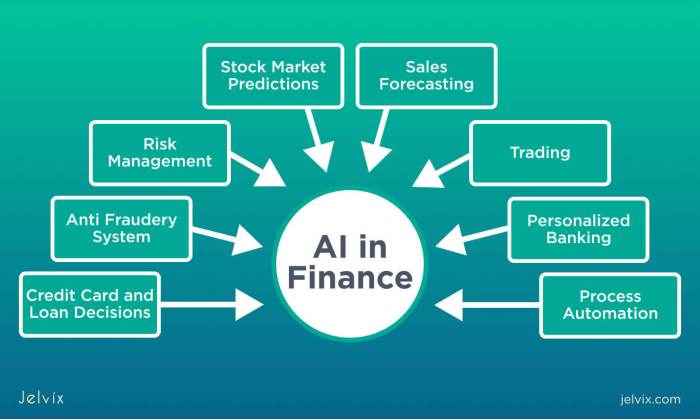

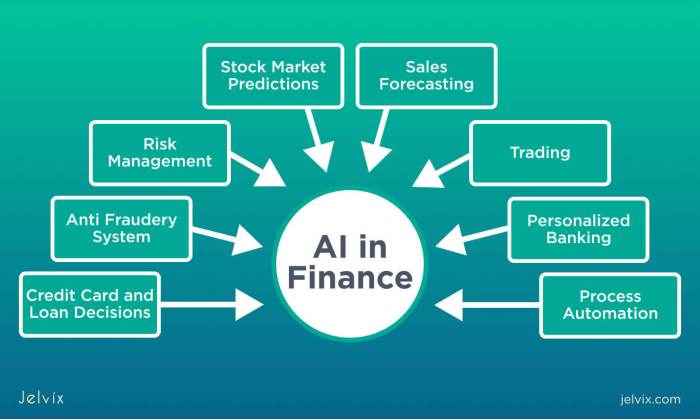

Overview of AI in Financial Services

Artificial Intelligence (AI) has been playing a significant role in transforming the financial services industry by revolutionizing the way tasks are performed and decisions are made. AI technologies are being utilized in various areas such as fraud detection, customer service, risk management, and trading, bringing about numerous benefits in terms of efficiency and decision-making.

Fraud Detection

AI algorithms are being employed to sift through vast amounts of data to identify patterns and anomalies that could indicate fraudulent activities. By analyzing transactions in real-time, AI can quickly flag suspicious behavior and reduce the risk of financial losses.

Customer Service

Chatbots powered by AI are being used by financial institutions to provide quick and personalized customer support round the clock. These virtual assistants can handle routine inquiries, process transactions, and even offer financial advice based on individual preferences.

Risk Management

AI-based risk management systems can assess and predict potential risks by analyzing historical data and market trends. By providing real-time insights, financial institutions can make informed decisions to mitigate risks and ensure regulatory compliance.

Trading

AI algorithms are used in algorithmic trading to analyze market trends, predict price movements, and execute trades at optimal times. This automation leads to faster and more efficient trading strategies, resulting in improved portfolio performance.

Applications of AI in Banking

AI technology has revolutionized the way banking operations are conducted, offering a wide range of applications that enhance efficiency, accuracy, and customer experience.

Personalized Banking

AI algorithms analyze customer data and behavior to provide personalized recommendations, offers, and services. By understanding individual preferences and financial needs, banks can tailor their services to meet customer expectations effectively.

Chatbots

AI-powered chatbots are utilized in customer service to provide instant responses to queries, guide customers through transactions, and offer support 24/7. These virtual assistants enhance customer satisfaction by providing quick and accurate assistance, improving overall experience.

Credit Scoring

AI algorithms are used to assess creditworthiness by analyzing vast amounts of data quickly and accurately. This enables banks to make more informed lending decisions, reducing the risk of default and improving the efficiency of the credit approval process.

Speed, Accuracy, and Customer Satisfaction

Traditional banking processes often involve manual tasks that are time-consuming and prone to errors. AI-driven solutions automate repetitive tasks, leading to faster processing times, higher accuracy, and ultimately, increased customer satisfaction due to streamlined operations.

Security Measures

AI plays a crucial role in enhancing security measures in banking transactions by detecting fraudulent activities, identifying patterns of suspicious behavior, and providing real-time alerts. This proactive approach helps prevent unauthorized access and ensures the safety of customer data and financial assets.

AI and Investment Management

AI algorithms play a crucial role in revolutionizing investment management by enhancing decision-making processes and optimizing portfolio strategies. By leveraging AI technology, financial institutions and investors can analyze market trends, predict stock prices, and automate trading operations efficiently.

AI Algorithms in Investment Strategies

AI algorithms are utilized in investment strategies to identify patterns in market data, assess risk factors, and optimize investment portfolios. These algorithms can analyze vast amounts of data in real-time, enabling investors to make informed decisions based on data-driven insights.

By incorporating machine learning models, AI can continuously learn and adapt to market changes, improving the accuracy of investment strategies over time.

Portfolio Management with AI

AI has transformed portfolio management by providing tools for risk management, asset allocation, and performance monitoring. Through AI-powered solutions, investors can create diversified portfolios tailored to their investment goals and risk tolerance. AI algorithms can also identify opportunities for portfolio optimization, ensuring efficient allocation of resources and maximizing returns.

Trading Automation using AI

AI enables trading automation by executing trades based on predefined algorithms and market conditions. Through algorithmic trading, AI systems can analyze market data, identify profitable trading opportunities, and execute trades at optimal times. This automation reduces human error, minimizes emotional decision-making, and enhances trading efficiency in fast-paced markets.

Challenges and Ethical Considerations

While AI offers numerous benefits in investment management, there are challenges and ethical considerations to address. One challenge is the potential for algorithmic bias, where AI models may exhibit discriminatory behavior based on biased data inputs. Additionally, the reliance on AI technology raises concerns about data privacy, cybersecurity threats, and the impact of AI on job displacement in the financial industry.

It is essential for stakeholders to implement transparent AI systems, ethical guidelines, and regulatory frameworks to ensure responsible use of AI in investment management.

AI in Insurance Industry

AI is transforming the insurance sector by revolutionizing various aspects such as claims processing, underwriting, and risk assessment. The integration of artificial intelligence technologies has brought significant changes and improvements to the industry.

Claims Processing

AI plays a crucial role in streamlining the claims processing workflow in the insurance sector. By utilizing machine learning algorithms and natural language processing, insurance companies can automate and accelerate the claims assessment process. This not only reduces the time taken to settle claims but also enhances the accuracy and efficiency of claim settlements.

Underwriting and Risk Assessment

In underwriting and risk assessment, AI algorithms analyze vast amounts of data to evaluate risks and determine appropriate premiums. By leveraging predictive analytics and machine learning models, insurance companies can make more informed decisions on underwriting policies and pricing strategies.

This helps in minimizing risks and ensuring profitability for insurers.

Enhanced Customer Experience and Fraud Detection

AI technologies are also enhancing customer experience by providing personalized services and tailored insurance products. Chatbots and virtual assistants powered by AI can interact with customers in real-time, addressing their queries and concerns promptly. Moreover, AI algorithms can detect and prevent fraudulent claims by analyzing patterns and anomalies in claim submissions, ultimately saving costs for insurance providers.

Future Developments

The future of AI in the insurance industry holds promising advancements and innovations. With the continued evolution of AI technologies, we can expect further improvements in claims automation, risk assessment accuracy, and customer engagement. Additionally, the integration of IoT devices and telematics data with AI systems will enable insurers to offer usage-based insurance policies tailored to individual behavior and preferences.

Final Review

In conclusion, AI is not just a buzzword in the financial services industry—it is a game-changer. From streamlining operations to enhancing customer experiences, the potential of AI knows no bounds. Embrace the future of finance with AI at the forefront.

Q&A

How is AI revolutionizing fraud detection in financial services?

AI algorithms can analyze vast amounts of data to detect unusual patterns or anomalies that may indicate fraudulent activities, providing a proactive approach to combating financial fraud.

What are the key benefits of using AI in risk management for financial institutions?

AI enhances risk management by offering real-time analysis of market trends, helping institutions identify potential risks and opportunities more effectively, ultimately leading to better decision-making.

How does AI contribute to personalized banking experiences?

AI enables banks to understand individual customer preferences and behaviors, allowing for tailored services, product recommendations, and proactive assistance through virtual assistants like chatbots.

What ethical considerations should be taken into account when using AI in investment management?

Ethical considerations in AI investment management include transparency in algorithm decision-making, ensuring fairness and accountability, and managing biases that may impact investment strategies.

How can AI improve operational efficiency in the insurance industry?

AI streamlines claims processing, automates underwriting processes, and assesses risks more accurately, leading to faster operations, reduced costs, and improved customer satisfaction in the insurance sector.

-

Trading6 months ago

Trading6 months agoSilver MCX Live Price Real Time Updates: Stay Ahead in the Trading Game

-

Investment6 months ago

Investment6 months agoExploring the Best Index Funds to Invest in 2025

-

Investing6 months ago

Investing6 months agoSilver MCX Live Price with Real Time Updates: A Comprehensive Guide

-

Business6 months ago

Business6 months agoExploring Digilifes Digital Transformation Case Studies

-

technology6 months ago

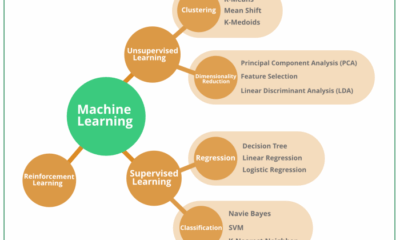

technology6 months agoExploring Machine Learning Algorithms: A Comprehensive Guide

-

technology6 months ago

technology6 months agoUnveiling the Power of Digilife Business Intelligence Solutions

-

Personal Finance6 months ago

Personal Finance6 months agoCrafting Your Wealth: Smart Dollar Wealth Building Strategies

-

technology6 months ago

technology6 months agoUnveiling the Future: Digilife Global Technology Trends 2025