Investing

Silver MCX Live Price with Real Time Updates: A Comprehensive Guide

Exploring the world of Silver MCX live price with real time updates, this introduction provides a detailed overview of how this market operates and the importance of staying informed with up-to-the-minute data. Dive into the realm of trading and investments with a focus on silver prices that can impact decision-making processes.

In the following paragraphs, we will delve deeper into the factors influencing silver prices, the significance of real-time updates, and the benefits of tracking Silver MCX live prices in real-time.

Overview of Silver MCX Live Price

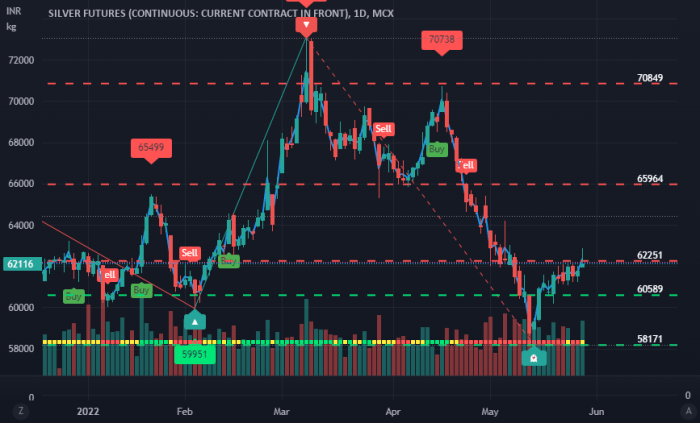

Silver MCX, also known as Silver Multi Commodity Exchange, is a platform where silver is traded in the commodity market. The live price of silver on MCX is determined by various factors such as global demand, supply, economic indicators, geopolitical events, and market sentiment.

Traders and investors rely on real-time updates of Silver MCX prices to make informed decisions and capitalize on market opportunities.

Importance of Real-Time Updates

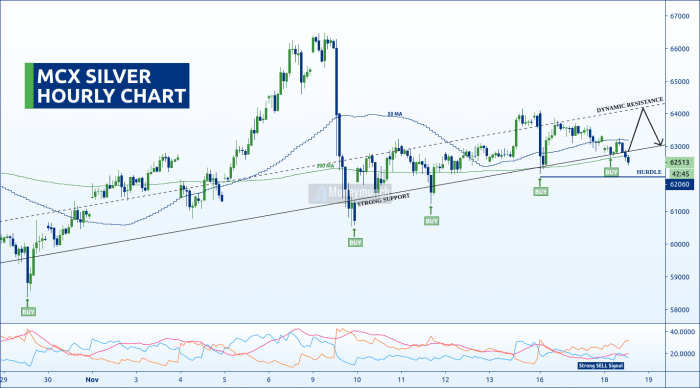

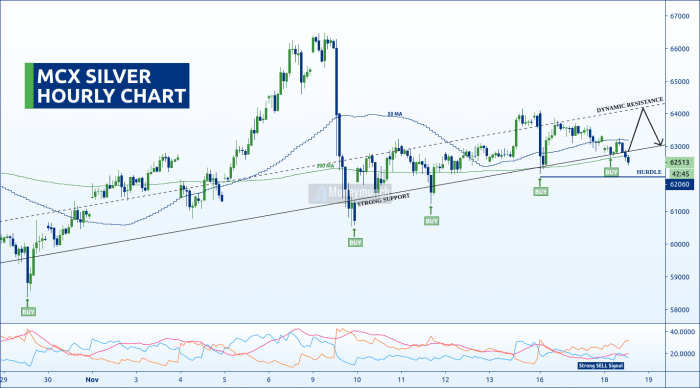

Real-time updates of Silver MCX prices are crucial for traders and investors to stay ahead of market movements. By monitoring live prices, they can analyze price trends, identify potential entry and exit points, and adjust their trading strategies accordingly. This real-time information helps traders make timely decisions and manage risk effectively.

- Real-time updates allow traders to react quickly to market changes and capitalize on trading opportunities.

- By staying informed about price movements, traders can make more accurate predictions and minimize potential losses.

- Access to real-time data helps investors track market trends and make informed decisions about their silver investments.

- Monitoring live prices enables traders to take advantage of arbitrage opportunities and maximize profits.

Factors Influencing Silver Prices

The price of silver on MCX is influenced by a variety of factors that can impact supply and demand dynamics in the market. Understanding these key factors is essential for traders and investors looking to navigate the silver market effectively.

Global Economic Indicators

Global economic indicators play a significant role in determining the price of silver on MCX. Factors such as GDP growth, inflation rates, interest rates, and currency fluctuations can all affect the demand for silver as a safe-haven asset. For example, during times of economic uncertainty, investors tend to flock to precious metals like silver, driving up prices.

On the other hand, when the economy is performing well, the demand for silver may decrease, leading to lower prices.

Geopolitical Events

Geopolitical events can also have a major impact on silver prices. Events such as political unrest, trade wars, or natural disasters can create instability in the markets, causing investors to seek out safe-haven assets like silver. The uncertainty and volatility associated with geopolitical events can lead to spikes in silver prices as investors look to protect their portfolios.

Understanding Real-Time Updates

Real-time updates for Silver MCX live price are sourced from various financial data providers and platforms that specialize in delivering up-to-the-minute information on commodity prices. These updates are crucial for traders and investors to make informed decisions based on the most current market data available.

Sourcing of Real-Time Updates

The real-time updates for Silver MCX are typically sourced from major financial news outlets, commodity exchanges, and specialized data providers. These sources collect and disseminate price data in real-time, ensuring that traders have access to the latest information on Silver prices.

- Financial News Outlets: Platforms like Bloomberg, Reuters, and CNBC provide real-time updates on Silver prices, along with analysis and market insights.

- Commodity Exchanges: The Multi Commodity Exchange (MCX) itself offers real-time price updates for Silver contracts traded on its platform.

- Data Providers: Specialized financial data providers like Investing.com, MarketWatch, and TradingView offer real-time charts and price quotes for Silver MCX.

Technology and Platforms for Real-Time Updates

Real-time updates for Silver MCX are delivered through advanced technology and platforms that ensure the timely and accurate transmission of price data. These platforms utilize high-speed data feeds, APIs, and sophisticated algorithms to provide instant updates to traders and investors.

- Data Feeds: Real-time updates are often delivered through data feeds that transmit price information directly from the exchange to trading terminals and platforms.

- APIs: Application Programming Interfaces allow developers to integrate real-time price data into trading applications and websites, enabling users to access live updates seamlessly.

- Algorithms: Automated algorithms are used to process and analyze real-time price data, providing insights and alerts to traders about market movements.

Frequency of Updates and Impact on Trading Decisions

Real-time updates for Silver MCX are typically provided on a second-by-second basis, allowing traders to monitor price movements and make quick decisions based on the most current information available. The frequency of updates can vary depending on the platform or data provider, but the instantaneous nature of real-time updates can have a significant impact on trading decisions.

- Timely Decision-Making: Real-time updates enable traders to react swiftly to market changes, helping them capitalize on opportunities and mitigate risks effectively.

- Increased Transparency: By providing real-time price data, traders have greater visibility into market dynamics, allowing for more informed trading strategies.

- Enhanced Accuracy: Access to real-time updates ensures that traders have the most accurate and up-to-date information at their fingertips, reducing the likelihood of making decisions based on outdated data.

Benefits of Real-Time Price Tracking

Real-time price tracking of Silver MCX live prices offers several advantages for traders and investors. By staying updated with the latest price movements, individuals can make more informed decisions and react quickly to market changes.

Enhanced Risk Management Strategies

Real-time updates on Silver MCX prices allow traders to better manage their risks by adjusting their positions based on current market conditions. For example, if prices suddenly drop, traders can quickly sell their positions to limit potential losses. On the other hand, if prices are rising, traders can capitalize on the opportunity to maximize profits.

Opportunities for Profitable Trades

Tracking Silver MCX prices in real-time can also lead to profitable trading opportunities. For instance, if a trader notices a sudden spike in prices due to a positive news event or market trend, they can quickly enter a position to ride the upward momentum and potentially earn significant profits.

Similarly, by monitoring price movements closely, traders can identify patterns and trends that can help them make more accurate predictions about future price movements.

Comparison with Other Precious Metals

When comparing silver prices with other precious metals like gold, it is important to consider the volatility of each metal in the market. Silver is known to be more volatile than gold, meaning its prices can fluctuate more rapidly over short periods of time.

Silver MCX Prices vs. Other Commodity Exchange Prices

- Silver MCX prices are specifically related to the Indian commodity market and are influenced by factors such as demand, supply, geopolitical events, and economic indicators within the region.

- On the other hand, other commodity exchange prices, like those of gold or platinum, are influenced by global factors such as international trade policies, inflation rates, and currency fluctuations.

Diversifying a Portfolio with Silver Based on Real-Time Updates

- Real-time updates on silver prices can provide investors with valuable insights into market trends and potential investment opportunities.

- By diversifying a portfolio with silver, investors can spread risk and take advantage of the different price movements of various assets.

- Silver's unique properties and its role as both a precious metal and an industrial commodity make it a popular choice for diversification.

Epilogue

In conclusion, understanding the dynamics of Silver MCX live prices and the role of real-time updates can be instrumental in making informed trading decisions. Stay ahead of the market trends and maximize your investment strategies by keeping a close eye on Silver MCX live prices with real time updates.

FAQ Resource

How is the live price of Silver MCX determined?

The live price of Silver MCX is determined by various factors such as demand, supply, global economic conditions, and geopolitical events.

Why are real-time updates important for traders and investors?

Real-time updates provide crucial information that can impact trading decisions instantly, allowing traders and investors to stay ahead of market movements.

What technology or platforms are used to provide real-time updates for Silver MCX?

Real-time updates for Silver MCX are usually sourced through trading platforms, financial news websites, and specialized market data providers.

How do real-time updates help in risk management strategies?

Real-time updates help in identifying potential risks and market trends quickly, enabling traders to adjust their strategies accordingly to manage risks effectively.

Can tracking Silver MCX live prices lead to profitable trades?

Tracking Silver MCX live prices in real-time can provide valuable insights that can lead to profitable trading opportunities based on market movements and trends.

-

Trading6 months ago

Trading6 months agoSilver MCX Live Price Real Time Updates: Stay Ahead in the Trading Game

-

Investment6 months ago

Investment6 months agoExploring the Best Index Funds to Invest in 2025

-

Business6 months ago

Business6 months agoExploring Digilifes Digital Transformation Case Studies

-

technology6 months ago

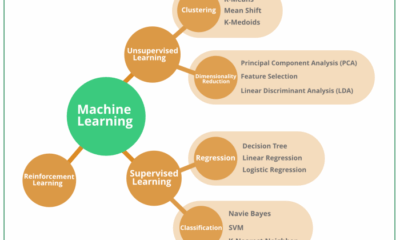

technology6 months agoExploring Machine Learning Algorithms: A Comprehensive Guide

-

Finance6 months ago

Finance6 months agoExploring BSE Midcap Index Today Market Insights

-

technology6 months ago

technology6 months agoUnveiling the Power of Digilife Business Intelligence Solutions

-

Personal Finance6 months ago

Personal Finance6 months agoCrafting Your Wealth: Smart Dollar Wealth Building Strategies

-

technology6 months ago

technology6 months agoUnveiling the Future: Digilife Global Technology Trends 2025